- SUMMARY

- IndiGo promoter Rahul Bhatia has divested 1.99% stake in the company.

- He has gained around Rs 3,400 crore from this block deal.

- Bhatia is excited about the next phase of growth of IndiGo.

Just a day after media reports stated about the potential stake sale, IndiGo Promoter Rahul Bhatia has sold 1.99% of his stake in the airline. The divestment was conducted via a block deal. The shares were sold via Interglobe Enterprises Ltd.

Rahul Bhatia will continue to be the Managing Director of the airline, with Pieter Elbers as the CEO.

Deal Done

On 11 June, Interglobe Enterprises Ltd on behalf of IndiGo promoter Rahul Bhatia sold 77,19,573 shares of the airline via a block deal. If you are unfamiliar with the stock market, it is basically a transaction between two companies at a mutually agreed-upon price.

A total of 77.2 lakh shares were offloaded, with each share valued at Rs 4,362.04. With this exchange, Rahul Bhatia gained approximately Rs 3,400 crore.

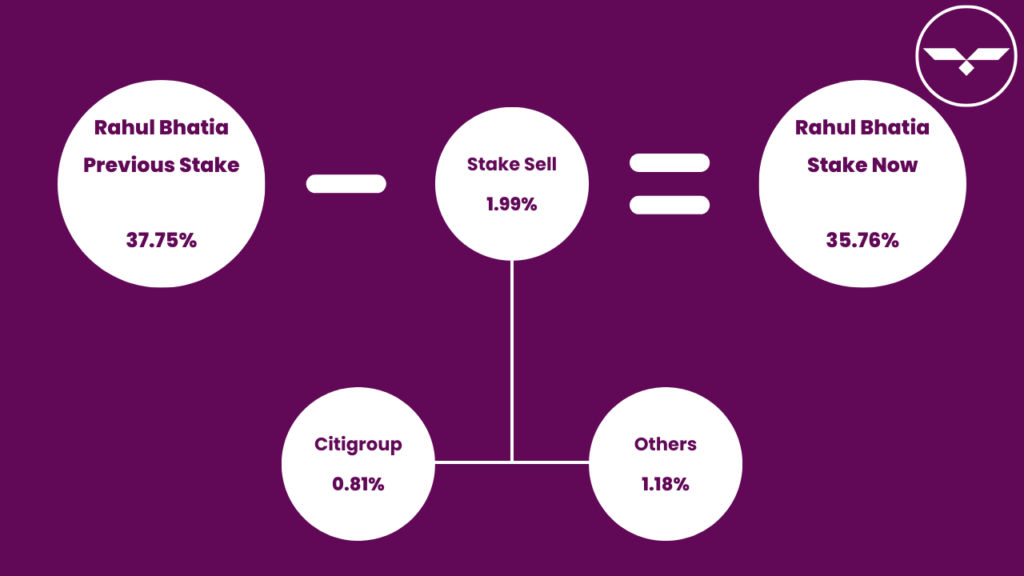

Citigroup Global Markets Mauritius bought 31 lakh shares for Rs 1,362 crore (0.81% stake of the airline). Information about other buyers is not available in the public domain.

After the divestment, Rahul Bhatia’s stake has come down from 37.75% to 35.76%. He will remain the largest shareholder in IndiGo. He will continue with his role as the Promoter and MD. Pieter Elbers being the CEO will continue to lead the airline.

Increasing Hospitality and Other Business

In a statement, Interglobe Enterprises mentioned that the funds generated from this stake divestment will be used to enhance the market scale of other businesses like hospitality. There are several subsidiaries of Interglobe. One of them is Interglobe Hotels, a Joint Venture between Interglobe Enterprises and Accor. It runs 21 hotels across the country.

For the next 12 months, Interglobe Enterprises has entered into a lock-up period. The company cannot sell any more shares during this period.

Bhatia said that the strong response from both current and new investors highlights the competitive strength of the airline and its long-duration aspect. The airline is a standout success. There is a long way to go in the Indian aviation market. Bhatia feels that IndiGo has the right strategy and management team in place to grab this opportunity. He said that he is excited about the next phase of IndiGo’s growth.

Conclusion: Rahul Bhatia of IndiGo Divests Stake

IndiGo MD Rahul Bhatia has divested 2% of his stake in the airline. He has generated funds of around Rs 3,400 crore. These funds will be used to scale other businesses like Interglobe Hotels. Rahul Bhatia’s stake has come down from 37.75% to 35.76%. 77.2 lakh shares have been offloaded.

What do you think about this stake sale from Rahul Bhatia? Discuss in the comment section.

Featured Image Credits: IndiGo via Facebook

Read the Latest Aviation News on Times of Aviation

Read More: General Authority of Civil Aviation Authorize Saudi Arabia Operations of Akasa Air

Website Disclaimer: Times of Aviation does not claim copyright ownership of any information or images used on this website. Usage of content falls under fair use.