- SUMMARY

- In a rare moment, Rahul Bhatia is expected to sell stake in IndiGo.

- 77 lakh shares will be offloaded by Bhatia.

- Gangwal is slowly reducing his stake, with latest stake sale in March.

In the past two years, there have been various instances in which IndiGo promoter and former board member, Rakesh Gangwal has sold his stake in IndiGo via block deals. An internal feud between Rahul Bhatia and Rakesh Gangwal led to Gangwal exiting from the airline board.

Now, for the first time in many years, promoter Rahul Bhatia is expected to sell his stake through block deals. Selling a stake via block deal refers to selling a significant portion of a company’s ownership in a single transaction, rather than going through the regular stock exchanges.

Rahul Bhatia to Sell Stake in IndiGo

According to a report from Moneycontrol, IndiGo promoter Rahul Bhatia is expected to sell around 2% of his stake in the airline in return for $394 million (Rs 3,293 crore). The deal has already been started. This is after a long time that Mr. Bhatia is aiming to unlock the value of IndiGo and gain some returns.

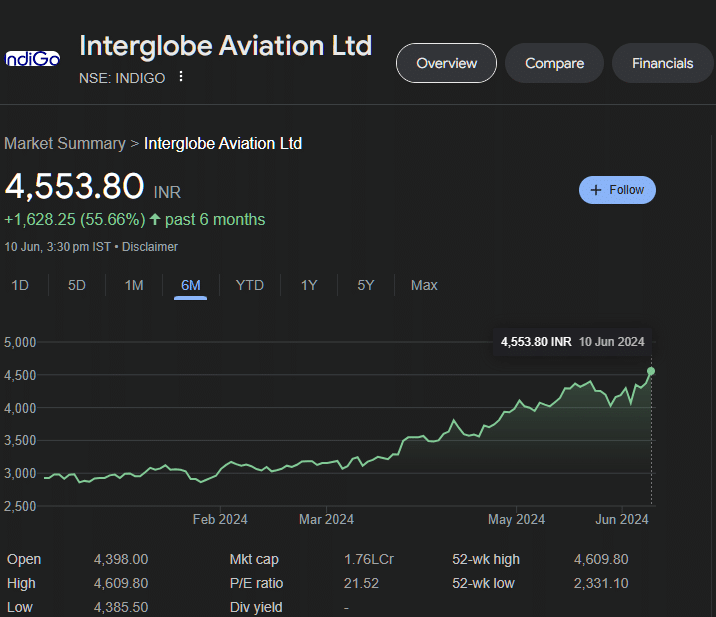

Interglobe Enterprises Pvt Ltd owns 37.73% of Interglobe Aviation. In the last six months, the stock has grown by 55.66%. From Rs 2,926 in December, the stock is now priced at Rs 4,553.

In the block deal, the base price for each share will be Rs 4,266. 7.7 million shares will be offloaded. This means a 6.5% discount to Interglobe Aviation’s closing price of Rs 4,562.55 per share. Citi will act as the investment banker for the deal.

Another source told the publication that there is a lock-up period of 1 year on the seller as per the deal terms. A lock-up period restricts the seller from offloading additional shares after a stake sale.

Why is Bhatia Offloading Stake?

IndiGo has announced record profits in the financial year ending March 2024. The airline has earned a net profit of almost $1 billion. In the fourth quarter, it posted a net profit of Rs 1,894 crore. It has announced staff bonuses.

IndiGo is not the only company, in which Rahul Bhatia has invested. He has travel portals, hotels, etc. He recently forayed into the Artificial Intelligence segment, when he collaborated with Tech Mahindra MD CP Gurnani to launch the company named AlonOS.

A source told MoneyControl that there are chances that funding would have been required for this new company. Hence, Bhatia is offloading shares in IndiGo.

Rakesh Gangwal, the former Board member at IndiGo left the airline a long time ago. He is slowly selling the stake held by him and his family. In March month, he sold a 5.8% stake in IndiGo for Rs 6,785 crore.

Conclusion

IndiGo promoter Rahul Bhatia is expected to offload around 2% of his stake in Interglobe Aviation. The airline’s stock has surged more than 50% in the last six months. Bhatia is looking to gain $394 million by selling 7.7 million shares. Gangwal is slowly shedding his stake in the airline.

What do you think about Rahul Bhatia offloading shares in IndiGo? Discuss in the comment section.

With Inputs From Moneycontrol

Featured Image Credits: IndiGo via Website

Read the Latest Aviation News on Times of Aviation

Read More: India Foray: AirAsia Indonesia Expected to Start Jakarta-Chennai and Bali-Kolkata Service

Website Disclaimer: Times of Aviation does not claim copyright ownership of any information or images used on this website. Usage of content falls under fair use.